Loan Process

Want to get pre-approved? Getting a pre-approval is not difficult and can vary depending on the lender, bank, or broker – some lenders may have an overlay. Get pre-approved today for a refinance or purchase by applying online or calling a loan specialist.

Step 1: Find Out How Much You Can Borrow

First step to obtaining a loan is to figure out how much you can borrower. It is important to figure out how much you can borrower before looking for a home.

An experienced Loan Originator will look at income, credit, assets, and liabilities. It is recommended that the Loan Originator properly pre-approves a borrower by running the Automated Underwriting System (AUS) to determine risk. This will allow them to see if the results are an automated approval (approve/eligible) or if the loan is refer/eligible to see if a manual underwrite is possible.

Getting properly pre-approved will allow a borrower to:

- Know how much they can borrow.

- Be in a position to negotiate with the seller and execute a sales contract before another offer is submitted to the seller.

- Close the loan in 30 days.

Getting Pre-approved for a Loan

Loan-to-Value (LTV) is a percentage of a loan amount by dividing the loan amount by the appraised value or sales price. There are loan programs that allow borrowers to borrower up to 100% LTV: VA loans and USDA loans will allow 100% financing.

When it comes to lending at a higher LTV, creditworthiness and the loan program play a huge role. A major consideration to approving a higher LTV has to do with the loan program and debt-to-income (DTI) ratios.

DTI is a percentage that takes revolving debt payments: student loans, auto loans, personal loans, minimum payment on credit card… etc and divide it by income. DTI is also a major factor when it comes to calculating maximum loan amount and maximum mortgage payment.

FICO Credit Score

FICO credit scores are used by all lenders, brokers, and banks to determine the approval decision. FICO (Fair Isaac Corporation) is a measure that is quantified to measure creditworthiness of a borrower. The mathematical model for credit score was developed by the Fair Issac Company in San Rafael, California, which is a measure that reflects the credit worthiness of an individual.

Factors that determine the FICO score include:

- Past payment history.

- Total amount borrowing.

- Type of credit established.

- Length of history.

- Credit inquiries.

- Other factors.

When your credit is pulled, it can adversely affect your credit score. It is important to have your credit pulled when you have chosen to apply for a loan.

Sources of Down Payment

- The borrower has to come up with the minimum required investment, or other fees payable by the borrower, and reserves (if applicable) by sourcing money.

- Funds must be sourced with 60 days bank statements and large deposits need to either be explained or seasoned for 60 days.

- When a borrower does not have the required down payment, “gift funds” are acceptable by an approved source/donor.

Step 2: Select the Right Type of Loan

When choosing a loan program, a borrower should make the most sense of their financial situation and goals while talking with their Loan Originator about the pros and cons.

There are two basic types of loans whether you are refinancing or purchasing a home. Each basic type of loan has different reasons a borrower would chose them.

1.) Fixed Rate Mortgage

- A fixed rate mortgage is the most common type of loan, which can come in different terms: the most common term for a mortgage is 15 and 30 years.

- Even if the interest rate is fixed, the payment can differ depending on taxes and insurance throughout the payment if taxes and insurance are escrowed.

- The principal and interest payment is fixed.

Some reasons why a fixed rate mortgage would be chosen:

- Plan to keep the mortgage and home for a long period of time.

- A borrower likes that fact that a principal and interest payment is fixed.

- Do not want to run the risk of a variable interest rate

- Income and spending are stable.

2.) Adjustable Rate Mortgage

- Adjustable rate mortgage also known as ARMS typically last for 15 and 30 years.

- These are attractive because the introductory rate and there are many different types of ARMS that are fixed for a certain period and adjust after.

- During the life of the loan, the interest rate may go up or down.

Reasons why this type of loan may interest a borrower:

- Do not mind payment going up and down.

- Comfortable with a payment increase in the future.

- Plan to live in the home for a short period of time: the pros out weight the cons.

- Plan to pay off the loan before the adjustable period.

Borrowers should select the type of loan that goes along with their present and future financial goals. When picking a loan program, borrowers should talk to a Loan Originator about their options.

Step 3: Apply for a Loan

Call today at (844) 953-0100 or Apply Online.

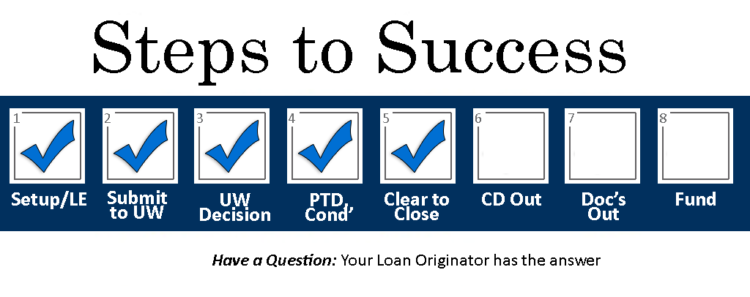

Step 4: Start the Loan Process

Lenders, banks, and brokers have guidelines, which can vary depending on the loan program and terms. Some lenders have overlays on top of set guidelines. The two major factors on an approval are based on the ability to repay and value of property.

- The process starts when the application, disclosures, and all necessary documents have been signed and received.

- When the initial documents pass loan setup, the underwriter will review the documents.

- A loan conditional approval or loan commitment will be sent with a list conditions, which are documents that are needed to be signed to receive a clear to close.

- The underwriter will review all the documents and clear the conditions.

- Once all the conditions are cleared, the underwriter will issue the clear to close by determining the borrower’s ability to repay along with other conditions on the property.

An experienced Loan Originator should have reviewed documents before underwriting, which include:

Income/Employment Check

- The income will need to suffice to meet lending guidelines for the loan program.

- Loan program guidelines are set and are risk based, which will take the income and debts into consideration.

Credit Check

- What are the revolving debts?

- What is the credit score?

- A credit report will be reviewed in order to determine the debt-to-income ratios and any lapses or delays in payments, which may have to be explained.

Assets

- Necessary funds for a down payment, fees, and reserves are required.

Property Appraisal

- The property will need to appraise for the sales price and be in acceptable condition.

- An appraiser will determine the market value and condition.

Other Documentation

In most cases, additional documentation will be required for a loan to be approved.

It is important that cooperation and completion with all tasks during the loan process are done in a timely manner in order for a loan to close on time.

Tips for Closing On Time

- Put detail into the application and send legible documents with all pages of the documents being requested.

- Response time should be prompt with any requests for additional documentation – especially when the rate is locked or if you have a deadline on the sales contract to meet.

- Sourcing money is important, to not move money around, and always having a paper trail of deposits.

- If there is a gift, ask your loan originator for a proper gift letter and acceptable sources.

- Do not make any major purchases until the loan is closed or finance anything during the process.

- Ask your loan originator about major purchase decisions – if there are new revolving debts, it can affect the debt-to-income ratios and have an adverse affect on the loan process.

- Going out of town is not the best decision during the loan process, but if you have to go out of town, talk to your Loan Originator to figure out how you can work through the process.

Step 5: Close Your Loan

Once the clear to close is issued, scheduling for closing will take place. Once a closing date is set and the final closing disclosure is issued, the closing will take place in front of a notary.

It is important to go over the final closing disclosure with your Loan Originator before closing and make sure the final closing disclosure matches at closing. A cashier’s check or money order is required for the cash to close (if applicable).

After the signing is completed, the funds will disburse with authorization and documents will be recorded