Mortgage Purchase Process

Want to get pre-approved? Looking to purchase a home? The mortgage purchase process is not difficult, but can be when service is not everything to a lender. Get properly pre-approval today and work with a mortgage company that will work around the clock to make sure your loan closes on time.

Wholesale Pricing and Programs

We work on the wholesale side, which often means more options, more programs, very competitive rates, and easier guidelines. Nationwide Mortgage & Realty, LLC is a one stop mortgage shop that can help with purchasing a home any day of the week.

Step 1: Find Out How Much You Can Borrow

The first step in obtaining a loan is to determine how much money you can borrow and getting a pre-approval. Figuring out how much you can borrower before looking for a home should be your first step.

Income, credit, assets, and liabilities are going to be the first thing that an experienced Loan Originator looks at in order to figure how much you can borrow. It is recommended that you get properly pre-approved by an experienced Loan Originator before you start looking for your new house so you:

- Know how much you can borrower.

- Be in a position to negotiate with the seller and execute a sales contract before someone else submits an offer.

- Close your loan in less than 30 days.

Getting Pre-Approved for a Loan

Loan-to-value and debt-to-income ratios:

- Loan-to-value (LTV) is a percentage of the loan amount to the appraised value.

- We have programs that will allow a borrower to borrow up to 100% LTV, such as VA loans and USDA loans.

- Loan programs and creditworthiness are a major factor when it comes to lending at a higher LTV ratio; major consideration to approving a higher loan-to-value has to do with the program itself and debt-to-income (DTI) ratios.

- DTI is a ratio that takes your revolving debts, such as student loans, auto loans, personal loans, minimum payments on a credit card, or other debt obligations divided by your monthly income.

- DTI plays a major factor when it comes to calculating your maximum loan amount, which all depends on taxes, insurance, and homeowner’s association dues.

FICO Credit Score

- FICO credit scores are used by all lenders with the approval decision.

- FICO stand for Fair Isaac Corporation, which is a quantified measure of creditworthiness of an individual.

- The score is derived from a mathematical model developed by the Fair Isaac and Company in San Rafael, California, which reflect the credit risk of an individual.

- The factors include past payment history, total amount borrowing, length of credit history, type of credit established, credit inquiries, and other factors.

- When shopping around for a new credit card, loan for a home, or when your credit is pulled, it can adversely affect your scores.

- It is advisable that you authorize a lender/broker to run your credit report only after you have chosen to apply for a loan through them.

Self Employed Borrowers

Self employed borrowers often find greater hurdles with borrowing than an employed borrower due to tax returns. For most loan programs, the problem with lending to a self employed borrower is documenting the applicant’s income. Borrowers who are employed can provide pay stubs and lenders can verify the income through their employer. In absences of verifiable income documents, the lenders rely on income tax returns, which they typically take two years into consideration.

Sources of Down Payment

Lenders expect the borrower to come up with the minimum required investment, other fees payable by the borrower, and reserves (if applicable) by sourcing money. Sixty days bank statements are required in order to source funds or the money has to be seasoned forSixtydays. If the borrower does not have the required down payment, “gift funds” are acceptable from an acceptable source/donor.

Step 2: Select the Right Type of Loan

There are many options when it comes to types of loan programs and a Loan Originator can form a loan that is right for you. When choosing a loan program, a borrower should make the most sense of their financial situation and goals while understanding the benefits of each. Whether you are purchasing a home or refinancing a loan, there are two basic types of loans. Each has different reasons you would choose them.

1) Fixed Rate Mortgage

The most common loan term for a fixed rate term are fifteen and thirty year loans. Throughout the term, the interest rate and monthly principal and interest payment remain the same. Mortgage payments can vary bases on taxes and insurance.

You would select this type of loan when you:

- Plan to live in the home for a long period of time.

- Like the fact that there is a fixed principal and interest payment.

- Don’t want to run the risk of a variable interest rate.

- Your Income and spending are stable.

2). Adjustable Rate Mortgage

Adjustable Rate Mortgages (often called ARMS), are typicallyfifteen and thirtyyear loans. During the term, the interest rate may go up or down, which may result in an increase or decrease to a payment. They are often fixed for a certain period of time and change after the fixed period. Borrowers are often interested in this type of loan if:

- Plan to sell before the rate adjusts.

- Do not mind that fact that payments can increase or decrease.

- Comfortable with the possibility of risk in future increases in payments.

- Think income will probably increase in the future.

When picking a loan program and lender, borrowers should seek professional advice and should go through the benefits of each loan program. Borrowers should select the loan that matches their present condition and future financial goals.

Step 3: Apply for a Loan

- Apply online or call (844) 953-0100

Step 4: Start the Loan Process

Lenders follow guidelines set by government agencies and loan approval guidelines vary depending on the loan program and terms. Some lenders have overlays on top of set guidelines. The two major factors on an approval are based on your ability to repay and value of the property.

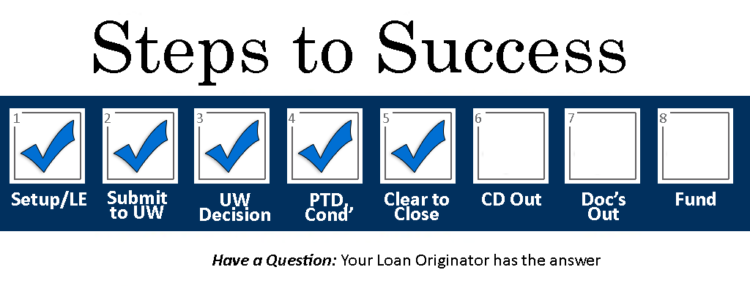

Once the application and disclosures along with all necessary documents have been received, the loan process will start immediately. Once the initial documents pass set up and the underwriter reviews the documents, a Processor and Loan Originator will work with you to satisfy conditions on the conditional approval/loan commitment. The underwriter will look at the following to determine your ability to repay along with other conditions, which an experienced Loan Originator should have reviewed prior to pre-approval:

Income/Employment Check

Will the income suffice to meet lending guidelines for the loan program? Loan program guidelines are set to evaluate income and debts.

Credit Check

What are your revolving debts? What is your score? Your credit report will be reviewed in order to determine a debt-to-income ratio and any lapses or delays in payments, which are considered to be explained.

Assets

Do you have acceptable funds that are necessary for a down payment, fees, and reserves?

Property Appraisal

Did the property appraise for the sales price and did it meet loan appraisal requirements? The appraiser will determine the market value.

Other Documentation

In some cases, additional documentation is required to determine if the loan will be approved.

Cooperation and completion is important to making the process go easy and closing your loan in a timely quicker:

- Take the time to put detail into the application and send legible and all pages of the documents requested.

- Respond promptly to any requests for additional documentation – especially when your rate is locked and if you have a sales contract with a closing date.

- Money has to be sourced so it is best not to move money or deposit money to a bank account without a paper trail.

- If you are receiving a gift, contact your Loan Originator and ask about gift letters and acceptable sources of gift funds.

- Please do not make major purchases until your loan is closed or finance anything.

- Consult with your loan originator before you make a major purchase.

- Purchases can affect the debt-to-income ratio and have an adverse affect on the loan process.

- If you plan to go out of town during the process or around your closing date, talk to your loan originator to talk about how you can work through the process to close on time.

Step 5: Close Your Loan

Once all of the conditions on the conditional approval/loan commitment have been cleared, the lender will issue a clear to close. The signing will take place in front of a notary.

Go over the final closing disclosure with your loan originator before closing and make sure the documents match when closing. It is important to bring a cashier’s check or money order to closing if required.

After the signing is completed, the funds will disburse when authorized and everything will be recorded.