What Causes an Escrow Shortage on Your Mortgage | Solutions

Has your mortgage payment increased? Escrow accounts are established to pay taxes and insurance unless waived during the loan process prior to closing. With home values on the rise, taxes and insurance are most likely to increase.

An escrow analysis is typically done once a year and the servicer will notify the borrower of a surplus, shortage, or deficiency.

What is an Escrow Account

An escrow account is established at closing for future taxes and insurance. Monthly payments are made towards an escrow account and when the payment becomes due, the servicer will pay the tax or insurance bill.

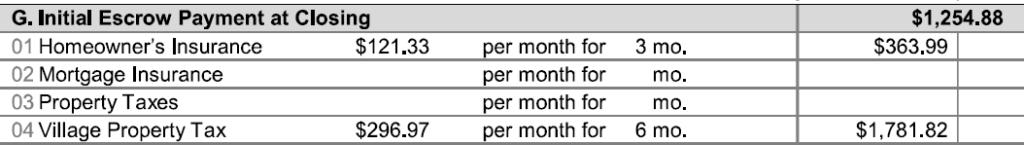

The initial escrow payment can be found on page two on a closing disclosure – line G. Initial Escrow Payment at Closing:

The initial payment at closing will vary based on due dates, tax, and insurance bill. The current escrow balance can be found on a mortgage statement. The escrow account is managed by the servicer.

Is it Possible to Cancel an Escrow Account

It is easier to choose to waive insurance and taxes during the loan process prior to closing than cancelling the escrow account. This often comes with a pricing adjustment but can benefit some borrowers depending on their ability to save money.

If the escrow account is waived, the borrower is responsible for paying taxes and insurance. The first step to take for cancelling an escrow account would be to call the servicer and ask if it is possible to cancel an escrow account. They will determine what guidelines they must follow to make this possible.

Why Did the Payment Increase – Taxes

Monthly payments are made towards an escrow account and when the payment becomes due, the servicer will pay the tax bill.

For example, say a home is assessed for $350,000 and was bought for $450,000. It is most likely that the county will adjust the assessed property value over time and increase the tax bill. Some factors that determine the tax bill, but not limited to:

- Miscellaneous taxes

- School taxes.

- Municipality/township taxes.

- County taxes.

- Tax rates.

- Exemptions.

- Property value.

- Assessed value.

- Other factors.

Taxing districts will vary depending on the area where the home is located.

Why Did the Payment Increase – Insurance

Homeowner’s insurance premiums will vary depending on the carrier and the risks involved. Some of the biggest factors that determine insurance rates are previous claims, the amount and type of coverage needed. Some other factors are, but not limited to:

- Age of home.

- Liability issues.

- Material cost.

- Weather.

- Labor costs.

- Where the home is located.

- Other factors.

It is possible to shop for insurance and get a lower premium, which will lower the escrow payment. Talk to your lender before switching insurance companies because there are rules and guidelines that need to be followed.

How to Fix Your Escrow Account

Possible ways to lower your escrow payment:

- Appealing your assessed value through the county.

- Shop for better insurance.

- Make a lump sum payment.

- Pay the new increased payment after the escrow analysis.

- Refinancing, if there is a net tangible benefit.