FHA Appraisal Transfer & FHA Appraisal Recertification

Looking for a lender that has an easier process and follows FHA guidelines? There are rules for an FHA appraisal transfer and a FHA appraisal recertification. Borrowers may want to switch mortgage companies and wonder how they can transfer a FHA appraisal.

Are you fed up with the loan process? Is your mortgage company taking too long? It is possible to transfer an FHA appraisal and there are guidelines when it comes to an FHA appraisal recertification. Some mortgage companies can have more difficult guidelines than others due to an overlay, which is an internal company guideline on top of FHA guidelines.

FHA Appraisal Transfer: Borrower Switching Lenders

Borrowers that want to switch mortgage companies must request to transfer the case to the second lender. The lender with the case must transfer the case to the second lender.

Step one: transfer the FHA case number, which is explained later in this article.

Step two: ask for a copy of the appraisal from the current lender.

- FHA guidelines state that the mortgagee must transfer the appraisal to the second mortgagee within five business days.

- The lender that has the appraisal is not required to transfer the appraisal until they are reimbursed – if the original lender has not been reimbursed for the cost.

FHA Appraisal Recertification – Update FHA Appraisal

When updating an FHA appraisal or re-certifying, here are some important key points to understand:

- The date in which the property was inspected by the appraiser is considered the effective date.

- It is important to make sure the FHA case number is not near the expiration date when transferring a case number because this could result in a re-inspection.

Updated FHA appraisals may only be acceptable under the following circumstances:

- The same appraiser who performed the original report.

- No decline in value.

- Any improvement the property that contributes to the value of the property, must be observed from the street or public way;

- Property reveals no deficiencies when doing an exterior inspection.

- The update must be done before the 120 day expiration; and

- The appraisal report has not been previously updated.

FHA Case Numbers: How to Transfer from One Lender to Another

In order for another lender to work on a loan that a previous lender has been working on, the FHA case number must be transferred.

- A Loan Originator can ask the new lender to do a case query on FHA Connection in order to figure out what the current FHA case number is.

- In some cases, the current lender with the case number will ask for a borrower’s authorization and letter of explanation that is signed and dated.

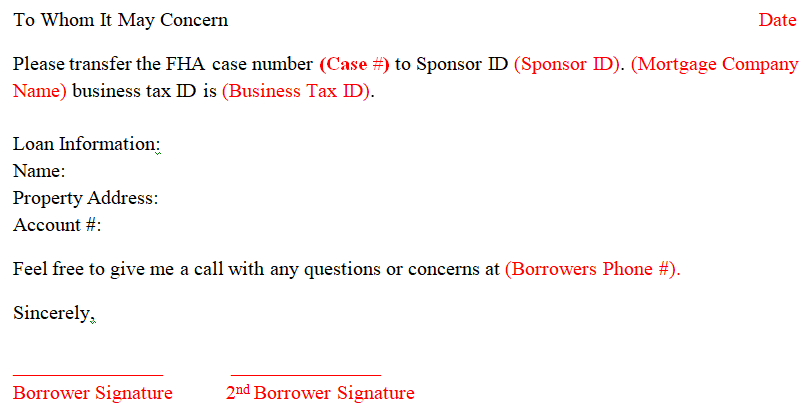

An example of a letter of explanation to send to the current lender to transfer the case number: