FHA Loan

Non-Permanent Resident Alien Mortgage Options Vs Permanent Resident Non-permanent resident aliens and permanent residents are eligible for traditional mortgages. Interest rates, down payment options, and closing costs are more competitive...

Read moreWhen are Extenuating Circumstances Required for a Mortgage ApprovalExtenuating circumstances may be required when there are charge offs, collections, delinquent accounts, judgments, and derogatory events. This is defined as a...

Read more3 FHA Down Payment and Closing Cost Grants | FHA GrantsThe FHA down payment grant is a competitively priced loan program that does not require a minimum down payment. You...

Read moreFHA Streamline Guidelines on Credit and Non-Credit Qualifying StreamlineFHA streamline guidelines can vary by lender if they have internal guidelines. The credit and non-credit qualifying streamline can be a great...

Read moreStaying Current with New FHA Guidelines & FHA Interest Rates It is important in the mortgage industry to stay current with the new FHA guidelines. There is an Automated Underwriting...

Read more2 Options for the FHA Rehab Loan | 203k Streamline and StandardIf you are looking for an FHA rehab loan, there are two options. The two types of FHA rehab...

Read moreNew FHA Cash Out Refinance Guidelines | FHA Debt ConsolidationAre you looking for the new FHA cash out refinance guidelines? Cashing out on your home allows you to pull equity...

Read moreUnderstanding FHA Guidelines and FHA Requirements for a MortgageAre you looking to gain a further understanding of FHA guidelines and FHA requirements? When applying for an FHA loan, being pre-approved...

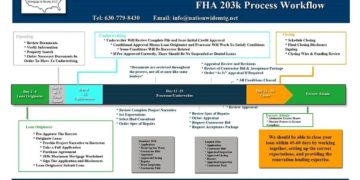

Read moreFHA 203k Process Work Flow | Steps to a Successful FHA 203k LoanAre you looking for a lender that does an FHA 203k loan? There are important details that the...

Read moreFHA Appraisal Transfer & FHA Appraisal RecertificationLooking for a lender that has an easier process and follows FHA guidelines? There are rules for an FHA appraisal transfer and a FHA...

Read more