FHA Streamline Guidelines on Credit and Non-Credit Qualifying Streamline

FHA streamline guidelines can vary by lender if they have internal guidelines. The credit and non-credit qualifying streamline can be a great opportunity to save you money. The two biggest qualifying factors are determining if you meet the mortgage payment history and FHA Net Tangible Benefit guidelines.

FHA Net Tangible Benefit (NTB) Guidelines

The first step is determining if you meet the FHA Net Tangible Benefit guidelines. This guideline was established to prevent borrowers from refinancing too often. Only one of the three Net Tangible Benefits must be met.

The three net tangible benefits:

- Combined rate reduction within the specific requirement.

- A reduction in term meeting a specific requirement.

- Changing from an adjustable rate mortgage to a fixed rate mortgage.

Combined Rate Reduction

If you currently have a fixed rate, the combined rate must be at least 0.5 percentage points lower than the new fixed rate. This includes both your Mortgage Insurance Premium (MIP) and interest rate.

Refinancing ARM to ARM depends on the payment change date and features of the interest rate. The Net Tangible Benefit is 1 to 2 percentage points depending on these factors.

If you want to switch from a fixed rate to an ARM, the rate must be at least 2 percentage points lower than the combined rate.

Changing from an Adjustable Rate to a Fixed Rate

If you want to switch from an ARM to a fixed rate, the rate must be no more than 2 percentage points higher.

A Reduction in Term

The term of the mortgage must be reduced by 6 months without increasing your payment more than $50. The combine principal, interest and Mortgage Insurance Premium (MIP) must:

- From a fixed rate, must decrease the new fixed rate, or

- Not increase more than 2 percentage points going from an ARM to a fixed rate.

Mortgage Payment History

For both credit and non-credit qualifying streamlines, the mortgage payment must be:

- Current through closing.

- No lates in the past 6 months from assigning an FHA case #.

- No more than 1×30 late from months 7 through 12 from the case # assignment.

The only credit document that an underwriter will review is a mortgage supplement. No minimum credit score is required on a non-credit qualifying streamline.

7 Benefits to the FHA Rate Reduction Program

- Refund of current escrow account.

- Streamline refinances can result in a lower payment or a shorter term.

- Defer up to two mortgage payments.

- When there is an escrow shortage, a new escrow account will be set up with the correct amount for taxes and insurance.

- No income required on the non-credit qualifying streamline.

- No appraisal.

- No minimum credit score.

FHA Streamline Guidelines

A borrower must meet a net tangible benefit when streamline refinancing.

- There is a net tangible benefit worksheet, which determines if a borrower is eligible for the streamline refinance program.

A mortgage history is ordered during the process, which must show:

- The mortgage current.

- Six months of satisfactory mortgage payment history.

- No more than one thirty day late for the previous six months for all mortgages from the case number assignment date.

- No minimum credit score, can use a mortgage history with no score for a non-credit qualifying streamline.

The mortgage must be already FHA-insured. Incidental cash back is allowed on an FHA streamline of up to $500. Any additional lender credit will be applied towards a principal reduction.

FHA Streamline Seasoning Requirements

For FHA-insured mortgages, at least six mortgage payments must have been made since the first payment due date. 210 days have to be passed from the closing date. An active Chapter 13 bankruptcy is permitted when:

- A borrower obtains court approval.

- Proof that the bankruptcy plan payment has been satisfactory.

A discharged Chapter 13 bankruptcy does not require seasoning. An active Chapter 7 bankruptcy is not permitted when streamline refinancing.

- Streamline refinances are permitted when Chapter 7 bankruptcy is discharged – no seasoning requirements.

Credit Qualifying vs. Non-Credit Qualifying Streamline

Credit qualifying streamline:

- Can add or remove a borrower from the loan.

- Verification of Employment and income are required.

- Requires a full credit report.

- No appraisal is required.

Non-credit qualifying streamline:

- Can add a borrower to the loan without income, but cannot remove a borrower.

- Does not require income and only a Verbal Verification of Employment is required.

- Does not require a full credit report.

- No Appraisal is required.

Upfront Mortgage Insurance Premium (UFMIP)

Upfront Mortgage Insurance Premiums are currently 1.75% of the base loan amount and in most cases are financed. Depending on the loan-to-value the mortgage insurance factors are typically:

- For loan-to-values at 90% or lower with a term greater than 15 years: .80% of the total loan amount with a duration of 11 years.

- Loan-to-value greater than 95% – more than 15 years: .85% of the total amount for the life of the loan.

- For a term with 15 years or less with at least 90% loan-to-value, .45% with 11 years duration.

- Loan-to-values greater than 90% for 15 years or less, .70% for the life of the loan.

If you have not refinanced since May, 31st, 2009, your Upfront Mortgage Insurance Premium would only be .01% and mortgage insurance factor is .55%.

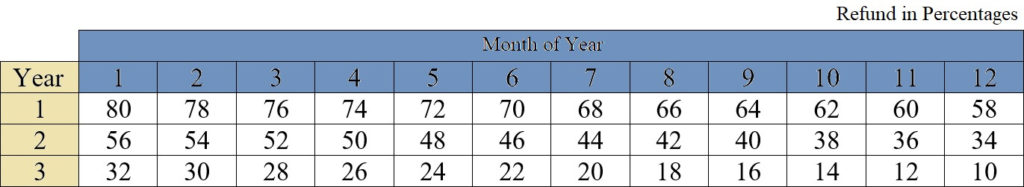

Upfront Mortgage Insurance Premium Refund

If you are refinancing your current FHA-insured mortgage to another FHA-insured mortgage within 3 years, you will get a refund credit that will be applied towards the new loan. The calculation is simple and will range from 80% to 10% depending on how long since your first payment. Your first payment starts at 80% and reduced by 2% for every month that passes.

Max Loan Amount Calculation

The maximum loan amount calculation is done through the FHA max mortgage worksheet. The maximum loan amount is based on the outstanding principal balance, payoff (interest and MIP can be financed), and the Upfront Mortgage Insurance Premium refund. It is important to get a lender credit to lower the cash to close. FHA Streamline interest rates can give you a credit towards closing costs, prepaids, and escrow.