How Do You Know if a Condo is FHA Approved | FHA Condo Mortgages

How do you know if a condo is FHA approved? Searching for an FHA loan for a condo has more moving parts than regular stick built homes. FHA condo approval guidelines are not difficult with the HUD’s search tool and a Loan Originators help.

3.5% Down Payment for a Condo

The down payment for an FHA loan for a condo is the same as a regular FHA loan.

- 3.5% for 580 or higher FICO credit score.

- 10% for lower than 580 FICO credit score.

FHA grants are available, with a minimum 620 FICO credit score, for 3% and 4% of the total loan amount to help with down payment and/or closing costs.

Home Owner’s Association Dues

The difference between most traditional homes and an FHA condominium is that the mortgage payment will have home owner’s association dues (HOA). This is a factor when determining a maximum mortgage payment even though it is usually paid outside the mortgage and not escrowed.

Approval Guidelines

In order for a FHA condominium project to be FHA approved, the project must be in full compliance with applicable state laws, all other applicable laws, and regulations. Some ineligible projects include:

- Condotels.

- Timeshares.

- Non-warrantable condos.

- Multi-dwelling unit condos.

- Houseboats.

- Projects that are not residential.

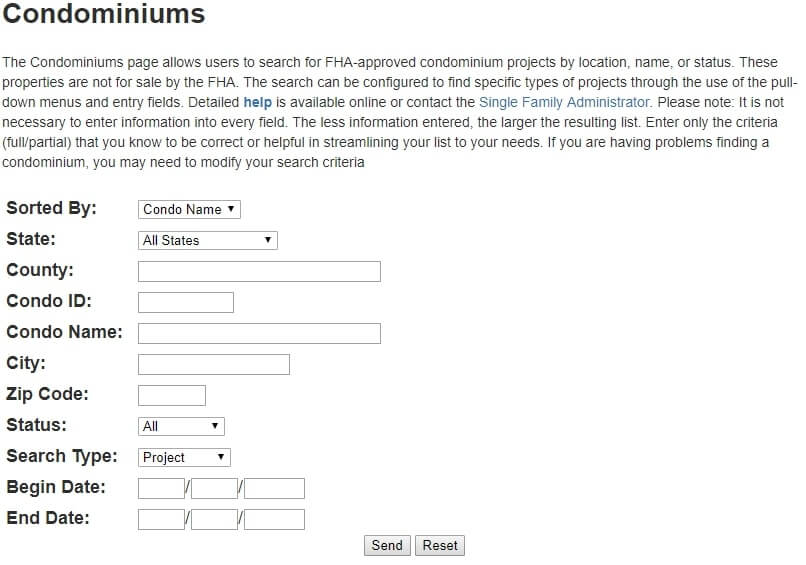

HUD’s search site makes it easy when asking the question, “How do you know if a condo project is FHA approved?” They make the process of looking for an FHA approved condo easy and not having to look through FHA guidelines.

How Do You Know if a Condo is FHA Approved

The condo search page allows anyone to look up condo projects by location, name, or status. Often, realtors or Loan Originators forget to check the status of the condo project. It is important to make sure each condo project is not only approved, but up to date. This will prevent any delays or disappointments during the underwriting process.

Starting the Loan Process

Some lenders have tougher guidelines than others. Getting pre-approved for a FHA loan for a condo starts with sending necessary documents required for underwriting and processing to a licensed Loan Originator. Once enough information has been collected, they will run the Automated Underwriting System (AUS) to determine a pre-approval purchase price and maximum mortgage payment.