DSR Loan for Investment Properties | Debt Service Ratio Calculator

The DSR loan, also known as a DSCR loan, is a way to qualify for an investment mortgage without personal debt-to-income ratios.

- DSR stands for debt-service ratio.

- DSCR stands for debt-service coverage ratio.

The DSR mortgage comes in 30 year fixed rates and a ARM whether refinancing or purchasing. The debt service ratio calculator is used to determine the cash flow of the property.

What is a DSR Loan

For traditional loans, personal debt-to-income can be an issue and the DSR mortgage can be a solution. Instead of using personal income, the DSCR loan must meet a ratio of 100% – there are no ratio options available too.

- These loans are not backed by Fannie Mae and Freddie Mac.

- They are made available through wholesale portfolio lending also known as Non-QM lending.

- This Non-QM lending program allows properties to close in an LLC (Limited Liability Company) or Corporation.

Property Types for the DSR Loan

- Single family residences and condos (warrantable and non-warrantable).

- Duplexes and townhomes.

- 3 to 4 multi-unit properties.

- Also have portfolio blanket loans.

- Multi-unit and 5-20 units for blanket loans.

Rental Income for DSCR Loan

Gross rental income is determined by the lower of the:

- Rental value of the property prepared by an appraiser (market rent of subject property); or

- If the subject property is leased, the actual rent for which the property is leased for.

If the subject property is not rented, the market rent of the subject property prepared by an appraiser is used. A rental addendum is used to determine market rent for the subject property.

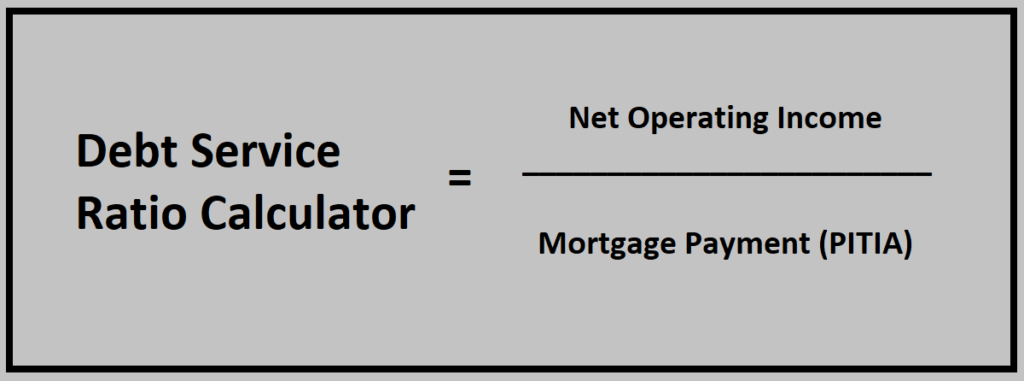

Debt Service Ratio Calculator

For a DSCR loan, a lender will use the debt-service ratio calculator:

Rent / (Principal and Interest (P&I) + Taxes + Insurance + Home Owner’s Association Dues (HOA)) = Debt-Service Ratio

The debt service ratio calculator is calculated by dividing the rent by total mortgage payment (PITIA). In order to qualify for the DSR mortgage, you want to be at a 100% debt-service ratio for better terms. For properties that do not qualify for the DSR loan, there are investor no ratio options too.

Property Condition

Properties must meet conventional appraisal standards, but there are investor fix and flip programs for properties that do not meet these standards. The investor rehab loan is a short term interest only loan based on a liquidity ratio rather than the debt-service ratio. They allow:

- Financing for the acquisition of the property.

- Financing for the rehab.

- To sell for profit or refinance to a permanent loan.