Using Future Rental Income to Qualify for Mortgage

Using future rental income to qualify for mortgage will increase your chances of an approval. Experienced investors go beyond their regular compensation and use supplemental income from a rental property to increase earnings. Why not use a lender to leverage your money to make residual income while your sleeping?

Investment Rental Income to Qualify for Mortgage

Depending on the state you live in and the property you are looking to invest in, the debt-service coverage of a property will vary. Experienced investors take all the following factors into consideration when investing in a property:

- Cash flow.

- Hedge against inflation.

- Passive income.

- Property value appreciation.

- Tax benefits.

Guidelines for using rental income to qualify for a mortgage depend on agency guidelines and the situation. General requirements for documenting income depend on if the transaction is a purchase or refinance.

Purchase Transaction

The projected rental income can be used on:

- One-unit investment properties.

- Two to four unit when one unit is occupied as a primary residence.

- Two to four unit investment properties.

- And some properties exceeding four units, which would be considered a commercial mortgage.

When using future rental income to qualify for mortgage, an appraisal rental addendum is required. The supplemental income that will used will go by the lesser of the appraiser’s fair market of rent or the actual rent the property is leased for.

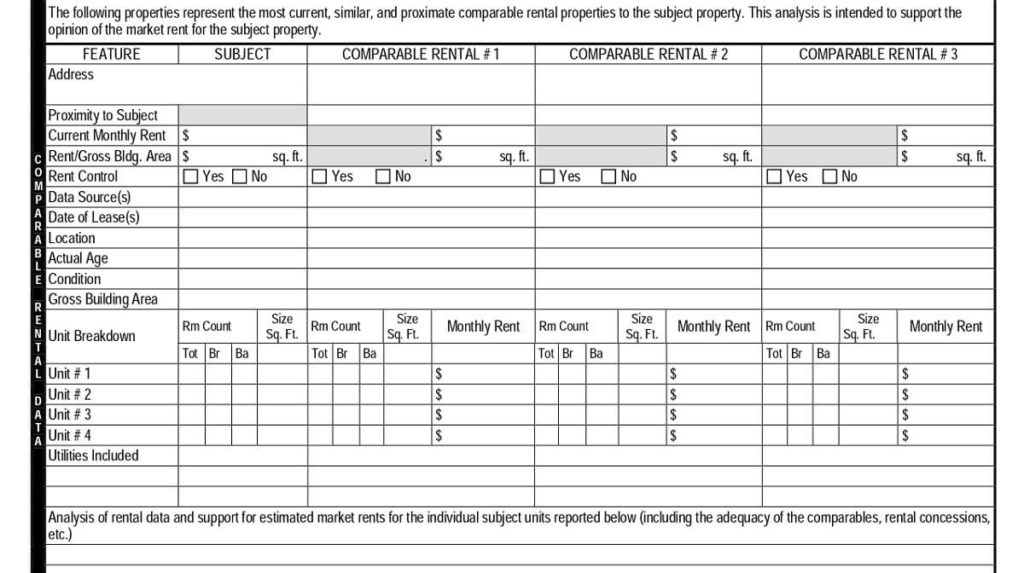

Appraisal Rental Addendum

For one-unit properties, the projected rental income is determined when an appraiser uses the Single-Family Rent Schedule (Form 1007). The Small residential Income Property Appraisal Report (Form 1025) is used for two to four unit properties to determine proposed rental income.

The gross monthly rent multiplier is 75% when using future rental income to qualify for mortgage. The guideline states that 25% of gross rent is typically absorbed by vacancy loss or ongoing maintenance expenses regardless of the situation.

Refinance Transaction

When refinancing a property, underwriters determine effective income by looking at a Schedule E or IRS Form 8825 on top of using an appraisal rental addendum.

A Cash Flow Analysis (Form 1084) is filled out, which certain items like depreciation are considered income. It is important to ask an account what you can depreciate to help when qualifying for a mortgage.

Multi-Unit Rental Income to Qualify for Mortgage

Two to four units can yield a better return on your investment, but most loan programs require a larger down payment. The minimum down payment for a traditional investment two to four unit mortgage is 25% unless you are going to occupy one of the units.

Non-QM loans allow you to put less of a down payment on a mortgage, but often have higher interest rates.

2 to 4 Unit Primary Residence Down Payment

Your three options when occupying one of the two to four units is an FHA loan, VA loan, or conventional mortgage.

- The down payment is 3.5% for an FHA two to four unit property.

- Conventional 5% down payment is possible with an Automated Underwriting System (AUS) approval.

Multi-unit properties often require reserves and reserve requirements are determined during the pre-approval process.

Reserve Requirements for FHA 2 to 4 Unit Properties

The minimum required reserves according to the guidelines are:

- Three months reserves for a three to four unit property.

- Two unit properties require one month in reserves when the loan is manual underwritten.

Three to four unit FHA loans require the property to meet a net self sufficiency test using projected rental income.

Net Self Sufficiency Test

The net self sufficiency rental income for the subject property is calculated by using the rental income produced by the property divided by the full mortgage payment.

All of the units rents, including the one being occupied, are added together. The rents are multiplied by the greater of the appraiser’s estimate of vacancies and maintenance or 75% of the total rent.

The total must cover the full mortgage payment, which consists of:

- Principal and interest.

- Taxes

- Insurance.

- Homeowner’s association dues, if applicable.

Vacating Property Rental Income

Using future rental income to qualify for mortgage can be used when vacating a property and buying a new property. FHA and conventional have different guidelines when it comes to using the supplemental income.

- When vacating a property and buying a new property with an FHA loan, the property must be 100 miles from the current address.

- You can also use the vacating properties rent for conventional loans.

Additional documentation is required, such as a lease agreement, evidence of payment, and security deposit. There are other options if debt-to-income ratios are too high for investment properties. No personal debt-to-income ratio is required for a debt-service coverage mortgage.

Debt-Service Coverage Mortgage

Using future rental income to qualify for mortgage without using personal debt-to-income ratios is possible through a Non-QM loan. The property is based off of cash flow of there property where the project income must cover the full mortgage payment.

The debt service ratio calculator = net operating income divided by the total mortgage payment (PITIA). They allow one to four unit properties and even non-warrantable condos.