Condo Mortgage Down Payment | Determining Approved Condo Projects

Are you looking for low condo mortgage down payment options or looking for a program that allows the type of condo you are trying to finance? It is important to understand that condo mortgage loan requirements vary before starting the process. Homeowner associations make and enforce rules and often there are agency requirements.

Take for example the FHA condo approval process. FHA insures condominium loans and requires the condo project to be FHA approved or meet the single-unit approval guidelines.

Condo Mortgage Down Payment

You may be pre-approved and looking for a low condo mortgage down payment options, but the project also must be approved. The three traditional loan options are:

- FHA 3.5% down.

- Conventional 3% down.

- VA 0% down.

- Condotel and non-warrantable.

You could even apply for a grant that does not require a minimum down payment.

FHA Condo Mortgage Down Payment

- The FHA condo mortgage down payment is 3.5% for a FICO credit score of 580 or higher.

- FICO credit score under 580 require 10% down.

- 2% to 6% FHA grants are available with a FHA condo approval with a minimum FICO credit score of 620.

There is a tool that makes it easy to see if a project is approved.

FHA Condo Approval Process

An FHA condo loan must be:

- Primarily residential.

- Have at least two dwellings.

- Can be detached or semi-detached.

- Row house, walk up, mid-rise, and high-rise.

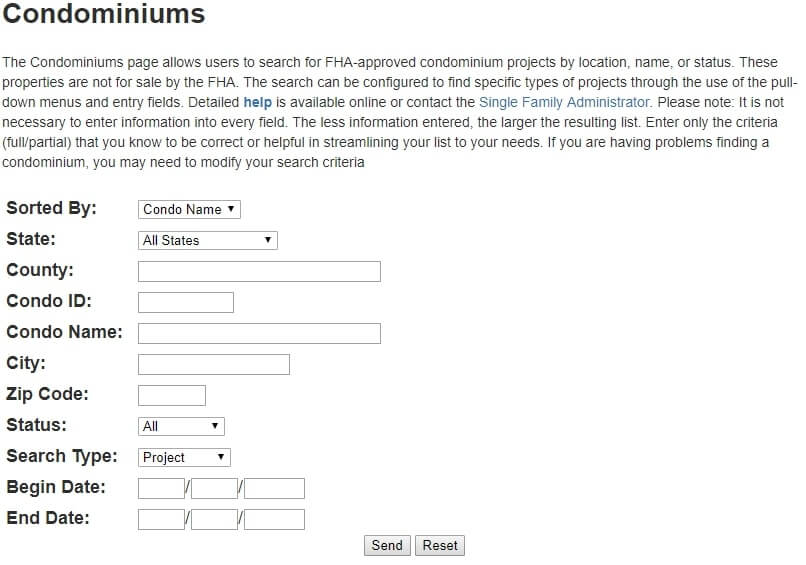

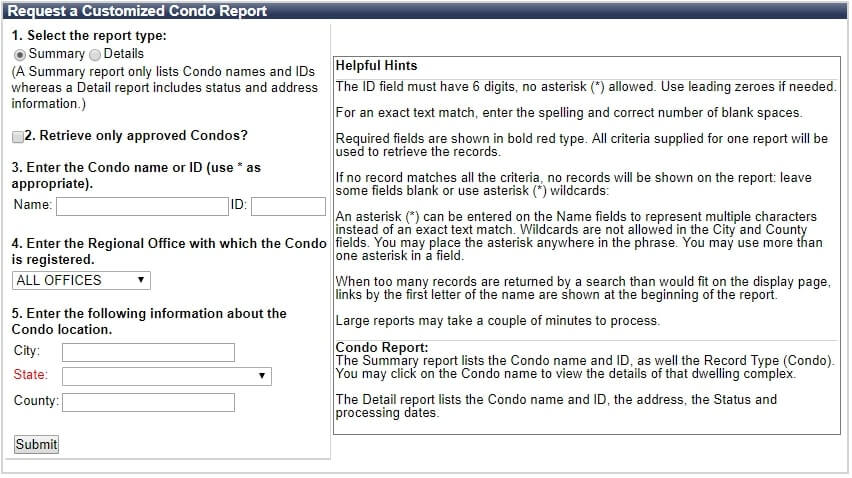

The HUD makes this easy to determine if a property by searching their database and finding the FHA condo approval. This will be a major factor when determining if the condominium project is approved. The search is as easy as going to the HUD’s condominium search page and checking the status of the project.

Conventional Condo Mortgage Down Payment

- The conventional condo mortgage down payment is 3% for primary residences.

- Conventional grants are available at 2%, 4%, 5%.

All condo projects need to follow agency guidelines.

Through Fannie Mae and Freddie Mac:

- Second homes require a minimum required investment of 10%.

- Investment properties require 15%.

VA Condo Mortgage Down Payment

The VA condo mortgage down payment is 0%. The VA has a search tool that lists condos status to see if they are eligible for VA financing. It is very common for a mortgage company to have a VA lender overlay. For example, some lenders require a minimum FICO credit score of 600, 620, or 640 or cap debt-to-income ratios.

Eligibility

Eligibly for financing can be determined any day of the week by a Loan Originator running the Automated Underwriting System (AUS) during the pre-approval process. They can also help with determining if a condominium project is approved.

They often will start by ordering a Condominium Project Questionnaire. Some lenders do not offer all financing options for condos and some require specialty financing.

Condotel and Non-Warrantable

Financing for projects that do not meet Fannie Mae or Freddie Mac’s special requirements are available through condotel or a non-warrantable condo loan.

Often, mortgage companies say they have financing a condo, but later find out that they cannot finance the property due to their internal guidelines. These loans are financed through wholesale portfolio lending or Non-QM loans.