Purchase

Conventional Mortgage Rates Up to $726,525 | Jumbo Loan ProgramsFor some lenders, where the conforming loan limit ends the jumbo loan begins. The conventional high balance loan limits start at...

Read moreDetailsGift Funds | Using Gift Funds for Down Payment | Mortgage Gift LetterAre you looking to use gift funds for down payment on a home? Using gift funds for a...

Read moreDetailsMortgage Bankruptcy Waiting Period | Foreclosure Waiting PeriodLooking for the conventional, VA, USDA, and FHA foreclosure waiting period and bankruptcy waiting period? The mortgage waiting period depends on the type...

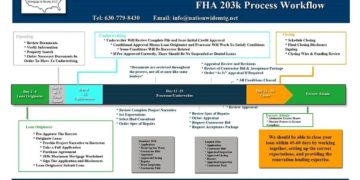

Read moreDetailsFHA 203k Process Work Flow | Steps to a Successful FHA 203k LoanAre you looking for a lender that does an FHA 203k loan? There are important details that the...

Read moreDetailsMortgage Seasoning Requirements | Cash Out Refinance Requirements Looking for mortgage seasoning requirements? Rate and term, cash out refinance requirements, and bankruptcy and foreclosure seasoning vary by loan program. There...

Read moreDetailsConventional Multifamily Financing Options | Duplex, Triplex, or FourplexLooking for multifamily financing for a duplex, triplex, or fourplex? Multifamily financing options vary by lender by minimum credit score requirements and...

Read moreDetails2 to 4 Unit FHA Multi-Unit Requirements | FHA 2 - 4 Unit Guidelines Financing for a multi-unit (2 to 4 unit) is possible with a FHA multi-unit mortgage. The...

Read moreDetailsTop 10 Common Mortgage Myths When Applying for a MortgageYou may find that lenders have different interest rates, minimum credit score requirements, different minimum down payment options, debt-to-income caps, and...

Read moreDetailsMortgage Pre-Approval Process | Properly Pre-Approved for a MortgageeLooking for a fast mortgage pre-approval? The mortgage pre-approval process is one of the most important steps to home ownership and the...

Read moreDetailsMultiple FHA Loans | Is It Possible To Have A Second Home FHA Dwellings that a borrower occupies in addition to a primary residence are considered a secondary residence and...

Read moreDetails