Rehab Loan Options for Owner-Occupied and Investment Properties

There are fix and flip loans for investment properties and traditional rehab mortgage loans for primary residences. Rehab loan requirements depend on the loan program. Renovation loans are a great solution when a property does not meet conventional or FHA appraisal requirements.

Conventional and FHA Appraisal Requirements

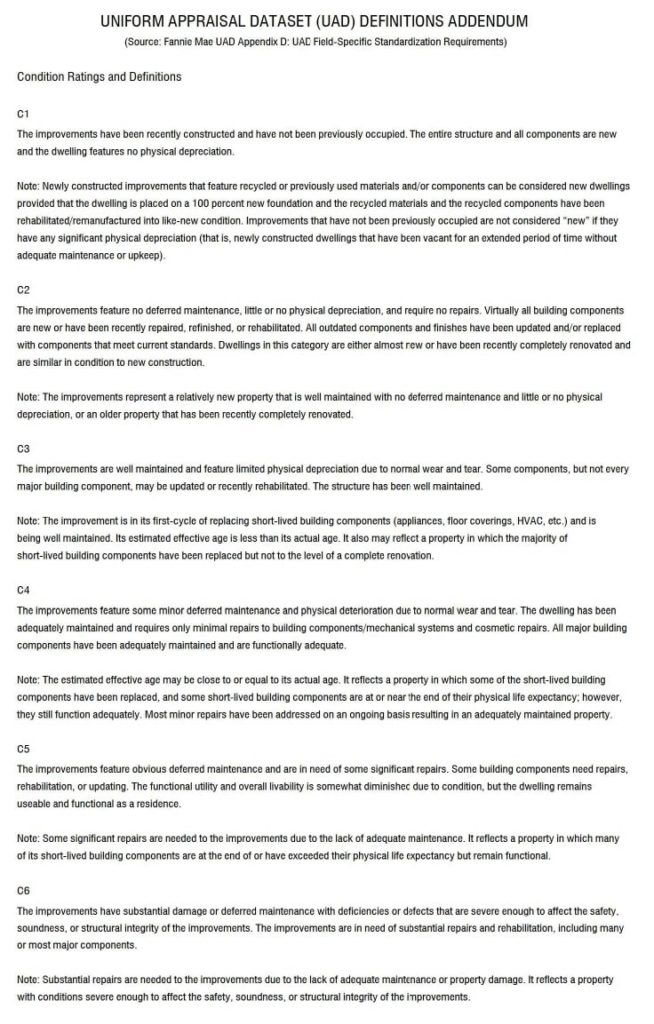

Properties receive an overall condition and quality rating that best reflects the property. This is prepared by an appraiser and will receive a rating between C1 through C6.

Conventional appraisal standards can be more lenient than FHA’s minimum property requirements. In some cases, a rehab loan may be necessary if deficiencies affect the safety, sounds, or structural integrity of the property.

Owner-Occupied and Investment Property Rehab Loans

An owner-occupied renovation loan allows long term financing for the purchase of the property and rehab. Cash out options are available for home improvements if there is equity in the home.

Investment property rehab loans are considered a non-qualified mortgage and often do not take personal debt-to-income ratios as a qualifying factor. They allow you to leverage your money to obtain financing for the acquisition of the property and financing for the rehab. The end goal would be to either sell the home or refinance into a permanent loan.

Investment Property Rehab Loans

Your options for renovation loans for investment property:

- Bridge loans.

- Fix and flip lines of credit.

- Single fix and flip.

Rehab Loan Requirements – Investment

In order to generate a quote, terms are based on:

- Past experience in the past 24 months.

- Estimated credit score.

- Years of real estate experience.

- Net worth.

- Liquidity.

- Active rental properties.

No experience is required for an investment renovation loan but comes with limitations. The more experience you have, the more competitive the terms are. They are short term interest only loans, but owner-occupied renovation loans are long term.

Owner-Occupied Renovation Loans

Your options for owner-occupied rehab mortgage loans:

- Conventional HomeStyle Renovation.

- FHA standard 203k.

- FHA limited 203k.

The first factor that you should look at is minimum credit score requirements for these programs. The minimum credit score is 620-640 FICO.

Rehab Loan Requirements – Owner-Occupied

The first step to see if you meet requirements is to go through the pre-approval process to determine a maximum mortgage payment. You can go over the pros and cons of each loan program to determine which one best fits your needs.

It is important to work with a Loan Originator who has experience with rehab loans because process can be more challenging.