Are Reverse Mortgages a Good Idea | Reverse Mortgage Benefits

Are reverse mortgages a good idea? There are reverse mortgage benefits that can be a smart financial option for seniors that meet the reverse mortgage age to gain access to additional funds.

Reverse Mortgage Definition

A reverse mortgage is also called a Home Equity Conversion Mortgage (HECM) and insured by the U.S. Federal Government. The reverse mortgage definition can be explained as a mortgage that taps into the equity of a home to be used as supplemental retirement income. The mortgage is opposite as a forward mortgage and works in reverse direction.

6 Reverse Mortgage Benefits

The reverse mortgage benefits are:

- No monthly mortgage payment.

- Equity in the home after paying the HECM loan goes to the heirs.

- Federal Housing Administration (FHA) insures the loan.

- In some states, loan proceed will not be taxed as income.

- A professional will be able to determine if this applies to you as a reverse mortgage benefit.

- Fixed and variable loan rates available.

- Depending on what you prefer, most closing costs and fees can be financed in the loan.

- This can result in little or no upfront fees.

Reverse Mortgage Age

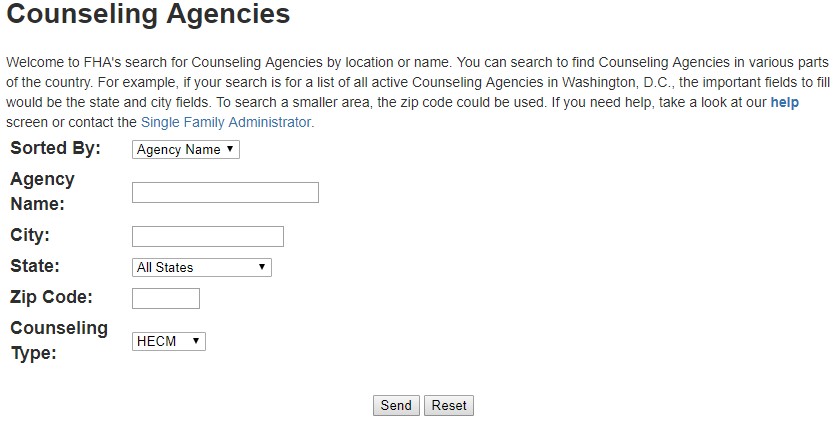

All borrowers must at least be 62 years old and must meet with a HECM counselor. The HUD has a FHA page that allows anyone to search for counseling agencies by location and name.

Reverse Mortgage After Death

One concern that you could have is what happens with the reverse mortgage after death? The person legally entitled to the property will receive equity after paying off the HECM loan.

Property Requirements for a Reverse Mortgage

The property must continue to be used as a primary residence and have a considerable amount of equity. The borrower is responsible for property insurance and taxes.

Other eligibility factors include the property meeting FHA requirements for a single family home, two to four unit owner occupied home, condo being FHA approved, and manufactured home requirements.

Reverse Mortgage Factors and Steps

Factors on the amount available are based on:

- Age of the youngest borrower.

- Current interest rates.

- Existing mortgage amount and appraised value; or

- HECM FHA mortgage limit.

There are 7 simple steps to the reverse mortgage process.