7 Steps on How a Reverse Mortgage Works | Reverse Mortgage Loan

A reverse mortgage loan allows senior homeowners to convert their equity into cash with no monthly mortgage payment. They are also known as a Home Equity Conversion Mortgage (HECM) that are insured by the Federal Housing Administration (FHA). Knowing how a reverse mortgage works helps when searching for a reverse mortgage program that fits your needs.

Defined – Reverse Mortgage Loan Meaning

The reverse mortgage loan may be a solution if you want to turn the equity in your home to supplement income while still living in the home. Instead of paying the mortgage forward, the mortgage is in reverse.

Reverse Mortgage Program Qualifications

- 62 years of age or older.

- Have a considerable amount of equity in the home.

- Occupy the property as a principal residence.

- Financial resources to pay for upcoming property taxes, insurance, and home owners association fees (HOA).

- Required to take counseling from a HUD-approved HECM counselor for a reverse mortgage loan.

Reverse Mortgage Program Benefits

- Not required to make mortgage payments.

- Repaid when the last surviving spouse ceases to occupy the property as a primary residence.

- Non-recourse meaning that no debt left to heirs.

- The additional equity is retained by the heirs.

- The FHA insures the loan.

- A professional can determine if this applies to you, but loan proceeds could not be taxed as income.

- Closing costs and fees can be financed, which result in little or no upfront fees.

How a Reverse Mortgage Works – Setup

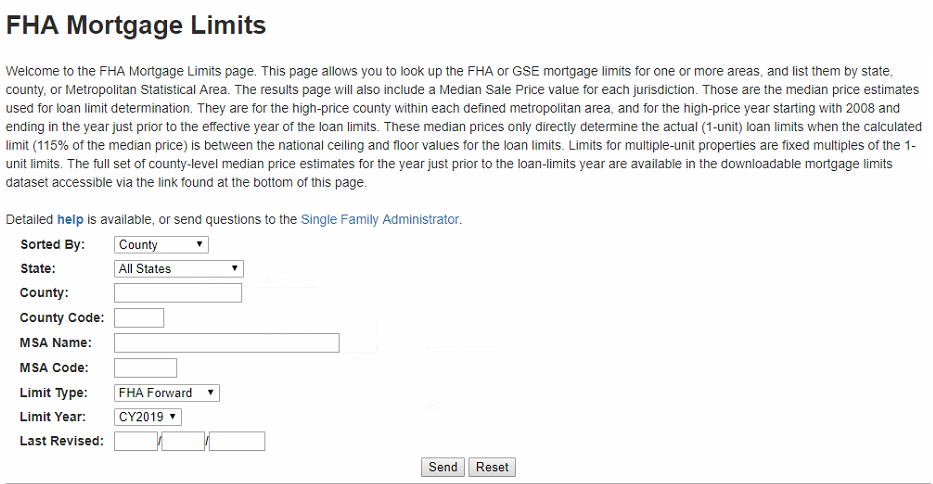

There is a HECM protocol when it comes to the reverse mortgage program. The average reverse mortgage loan takes 30-45 days to close.

Complete Reverse Mortgage Counseling

1st step: meet with a HUD approved reverse mortgage loan counselor. They will educate you about reverse mortgages and other financial options. They will be available to a borrower for guidance, support, and ongoing decisions through the process.

Get a Quote

2nd step: get a quote and go over it. Going over options, such as single payment, line of credit payment, and other term payment plans. You can change this payment plan at any time, but a payment plan is selected at closing.

Loan Process

3rd step: go over details for a loan application and sign the application. During this step, you will go over a list of documents required for the reverse mortgage program. Once the application is signed and all required documents are sent to a Loan Originator, they will submit the loan to underwriting. You can cancel the application at any time during the loan process.

Go Over the Loan Approval

4th step: work with a Loan Originator to go over loan stipulations. A loan commitment is issued by an underwriter and most required documents are on the Loan Originators end. They may need minor documents in order to clear conditions to obtain a clear to close.

Review Documentation

5th step: go over documents with and a Loan Originator and wait for a clear to close.

Closing

6th step: once the reverse mortgage is clear to close, closing is schedule. The payment plan will be confirmed if you wish to receive fixed monthly payment or a line of credit. A lump sum can be received at funding. Once figures are finalized, you will go over figures with the Loan Originator and title agent. A borrower has three days to cancel the reverse mortgage loan when refinancing.

Funding

7th step: loan funds after all closing documents are reviewed and the applicable recession period passes.

Reverse Mortgage Equity

For a refinance transaction, the amount is equal to the lesser of the maximum mortgage amount allowed by FHA or the appraised value.

For a purchase transaction, the maximum amount is the lesser of the contract price, appraised value, or the FHA lending limit.